How to Make Sure Your Auto Insurance Meets Your Needs

How to Make Sure Your Auto Insurance Meets Your Needs

Blog Article

Optimize Your Peace of Mind With the Right Car Insurance Coverage Plan

Navigating the complexities of automobile insurance can often really feel frustrating, yet it is important for guaranteeing your comfort on the road. By comprehending the different kinds of coverage available and examining your private requirements, you can make educated choices that align with your lifestyle and budget. In addition, the process of contrasting providers and identifying possible price cuts can lead to considerable savings. Nonetheless, the most effective approaches for tailoring your vehicle insurance policy strategy may not be right away noticeable-- this discussion will discover necessary insights that can change your technique to protection.

Comprehending Automobile Insurance Basics

Recognizing the principles of auto insurance coverage is essential for each automobile proprietor. Car insurance policy works as an economic safeguard, safeguarding people from possible losses resulting from accidents, theft, or damage to their cars. At its core, auto insurance coverage is comprised of different coverage kinds, each made to attend to certain risks and responsibilities.

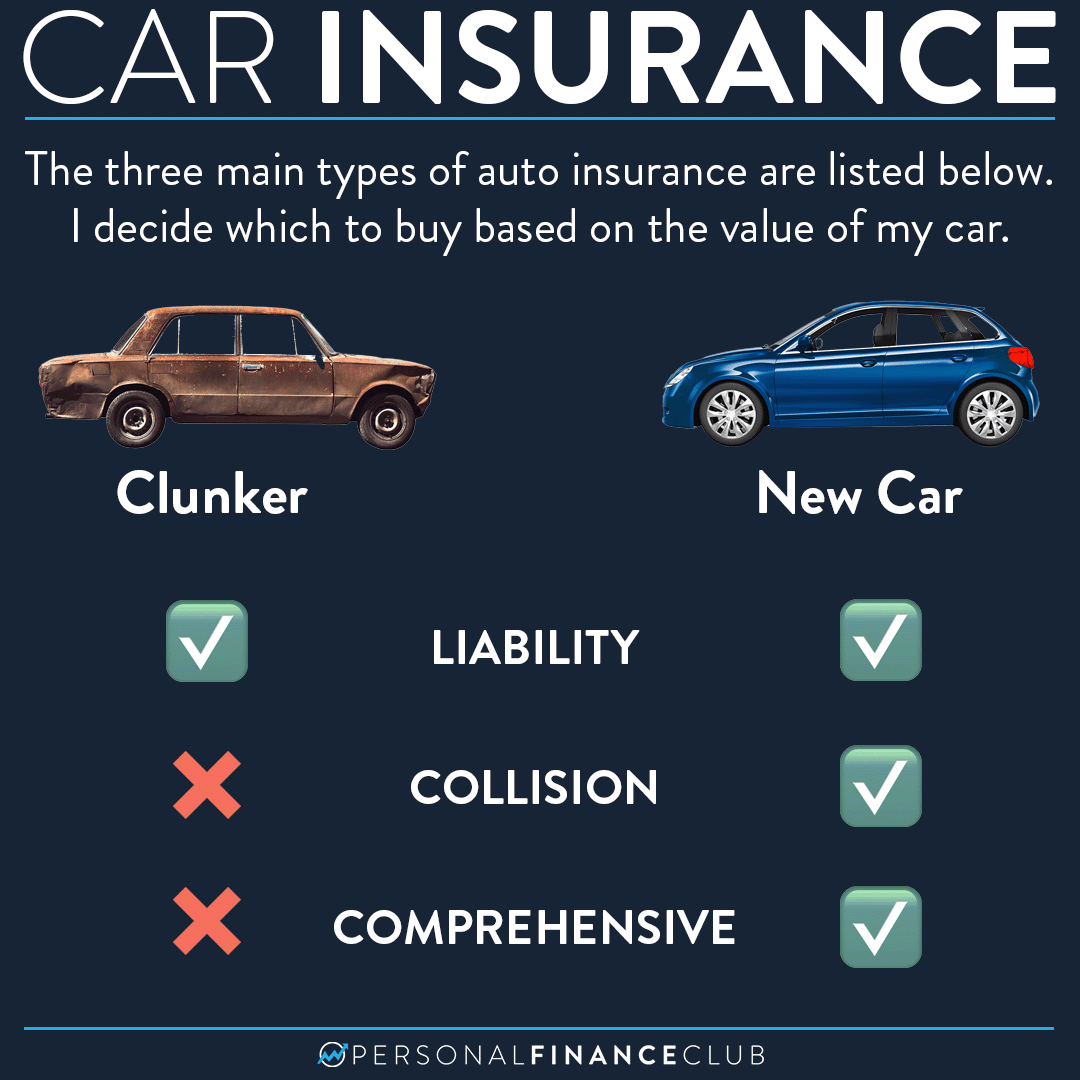

The main elements consist of obligation protection, which safeguards versus problems caused on others in a mishap; crash insurance coverage, which spends for repair services to your vehicle after a collision; and thorough coverage, which covers non-collision-related incidents such as burglary or natural calamities. Furthermore, several plans supply individual injury defense (PIP) or uninsured/underinsured motorist protection, which can supply critical support in case of a crash with an at-fault driver who does not have enough insurance coverage.

Costs for automobile insurance are influenced by a multitude of aspects, consisting of the chauffeur's history, the kind of lorry, and regional guidelines. Understanding these essentials furnishes lorry owners to navigate the intricacies of their policies, inevitably bring about notified decisions that straighten with their unique needs and situations.

Evaluating Your Protection Requirements

When identifying the proper auto insurance protection, it is essential to examine private situations and threat aspects. Understanding your driving routines, the type of lorry you own, and your financial situation plays a considerable role in picking the right plan.

Frequent travelers or those who usually drive in high-traffic areas may need more extensive coverage than periodic vehicle drivers. Newer or high-value cars commonly profit from crash and thorough insurance coverage, while older lorries could just need responsibility protection.

If you own substantial assets, greater responsibility restrictions may be needed to safeguard them in instance of an accident. Some people like to pay greater costs for included tranquility of mind, while others may select very little protection to save money.

Contrasting Insurance Companies

Following, think about the series of coverage alternatives each supplier provides. Search for plans that line up with your specific requirements, consisting of liability, collision, extensive, and uninsured motorist insurance coverage. Furthermore, analyze any kind of readily available add-ons, such as roadside help or rental cars and truck compensation, which can enhance your plan.

Rates is one more crucial aspect. Obtain quotes from several service providers to understand the price differences and the protection offered at each rate point. Be aware of the limits and deductibles related to each policy, as these variables significantly affect your out-of-pocket expenses in the occasion of a case.

Lastly, evaluate the cases process of each copyright. An uncomplicated, reliable insurance claims treatment can considerably affect your general fulfillment with your automobile insurance policy experience.

Tips for Lowering Premiums

Lots of chauffeurs aspire to find ways to lower their car insurance policy premiums without giving up necessary insurance coverage. One effective method is to enhance your deductible. By choosing a higher deductible, you can considerably minimize your month-to-month costs; however, guarantee that you can pleasantly afford the out-of-pocket expenditure in case of a case.

One more technique is to take benefit Related Site of discounts supplied by insurance companies. Numerous firms provide savings for elements such as safe driving records, bundling several policies, or having specific security functions in your automobile. Constantly ask about readily available price cuts when obtaining quotes.

Keeping a good debt rating can also lead to lower costs, as many insurance firms consider credit score background when establishing rates. Consistently assessing your credit rating report and attending to any discrepancies can aid boost your score in time.

Finally, think about the kind of lorry you drive. Autos that are less expensive to fix or have greater safety scores usually include lower insurance policy prices. By examining your automobile option and making notified choices, you can successfully handle your automobile insurance coverage costs while guaranteeing ample coverage continues to be undamaged.

Evaluating and Updating Your Plan

Frequently reviewing and updating your car insurance coverage plan is important to make sure that your protection aligns with your existing requirements and circumstances. auto insurance. Life modifications, such as purchasing a brand-new car, transferring to a different area, or modifications in your driving habits, can dramatically impact your insurance coverage demands

Begin by evaluating your existing insurance coverage restrictions and deductibles. You may want to change your company website accident and comprehensive protection appropriately if your vehicle's value has actually depreciated. Additionally, take into consideration any type of brand-new price cuts you may qualify for, such as those for secure driving or packing policies.

It's likewise prudent to review your personal circumstance. If you have actually experienced substantial life occasions-- like marriage or the birth of a kid-- these may necessitate an update to your plan. If you have embraced a remote image source job setup, your daily commute may have transformed, potentially affecting your insurance requires.

Finally, consult your insurance policy copyright at the very least each year to review any type of modifications in rates or coverage alternatives. By taking these positive steps, you can make sure that your automobile insurance plan provides the finest protection for your developing lifestyle.

Verdict

In final thought, choosing the proper automobile insurance coverage plan needs a complete understanding of coverage types and mindful assessment of specific requirements. By contrasting different insurance coverage suppliers and actively looking for discount rates, policyholders can obtain an equilibrium in between adequate protection and price. Consistently upgrading the policy and assessing makes sure proceeded importance to changing scenarios. Ultimately, a well-chosen automobile insurance policy strategy offers to enhance satisfaction, supplying both financial protection and self-confidence while navigating the roads.

The most efficient methods for customizing your automobile insurance coverage strategy may not be promptly apparent-- this conversation will certainly discover necessary understandings that can transform your method to protection.

In the procedure of picking an auto insurance provider, it is crucial to perform a thorough comparison to ensure you find the best coverage for your demands - auto insurance. By reviewing your vehicle option and making notified decisions, you can effectively handle your automobile insurance policy expenditures while guaranteeing sufficient insurance coverage continues to be intact

In conclusion, selecting the proper auto insurance coverage strategy calls for a thorough understanding of coverage types and mindful analysis of private needs.

Report this page